To open a merchant account or business account for MSMEs, the following requirements must be met: First, an individual account is needed as a prerequisite before requesting a merchant account. To apply for a merchant account, please complete the online application form on your Netbank Mobile. Follow the instructions below.

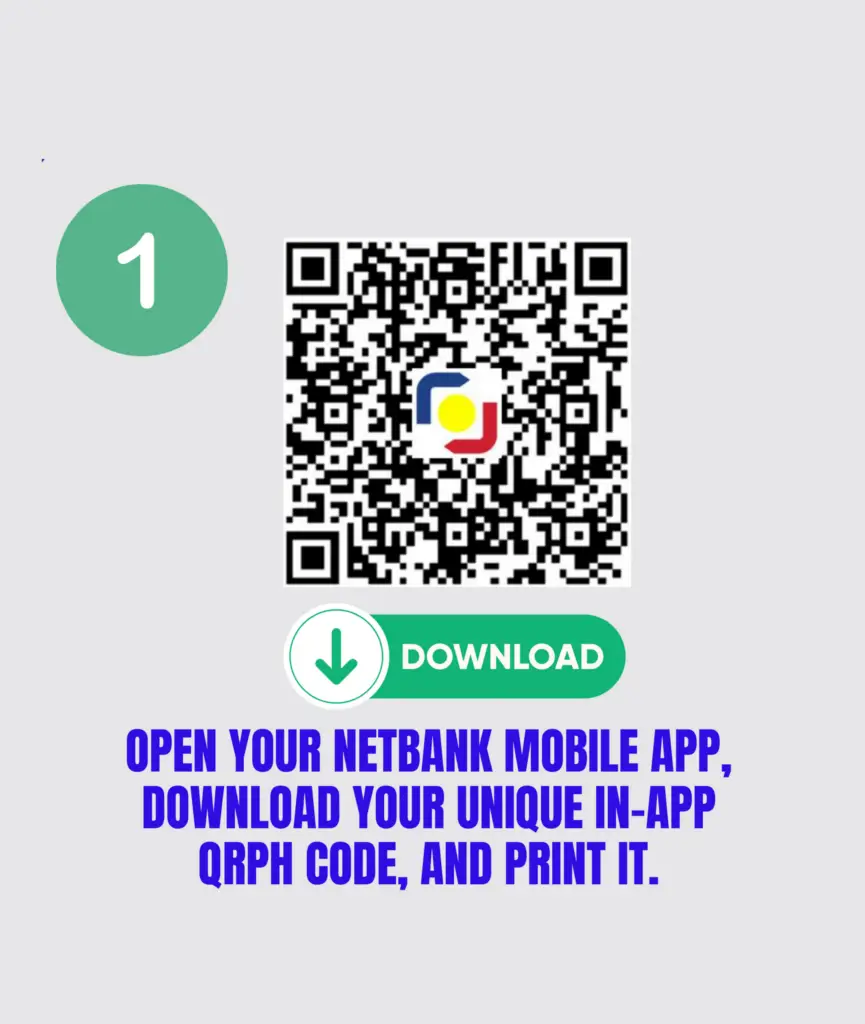

1. Open the App

2. Click Settings

3. Click FAQ

4. Select “Merchant Account”

5. Tap “Merchant Account Opening”

6. Complete the required Field and Submit

Prepare the following documents:

This merchant account also offers interest at 2% with daily crediting.

The Turnaround time for the Approval after the user submits the merchant account application or after registration is listed below.

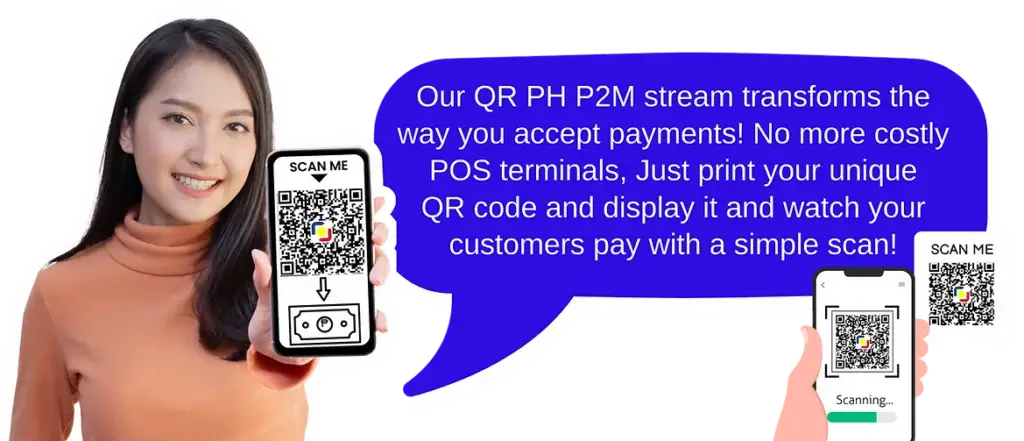

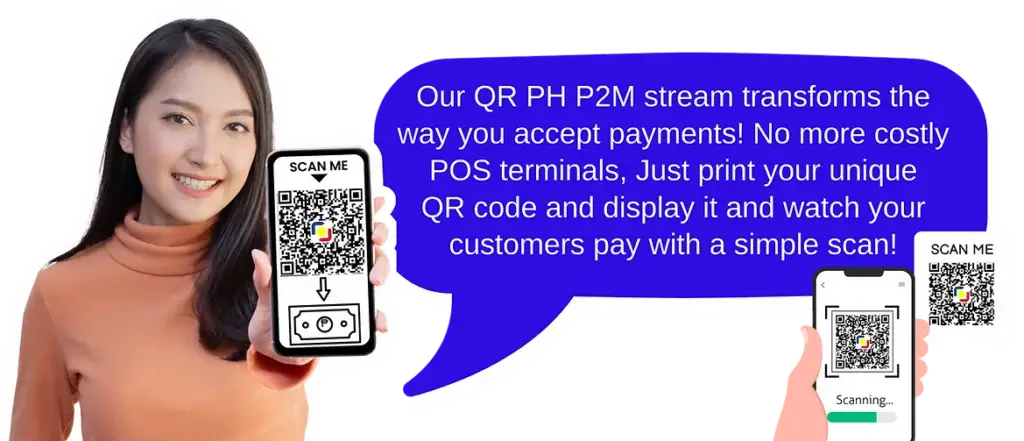

Netbank is a participant in QR (Quick Response) PH (Philippines) P2P (Peer-to-Peer) and P2M (Peer-to-Merchant) transactions.

Netbank Mobile is redefining financial accessibility! Imagine a world where every Filipino, from families to underserved communities, has the tools to take control of their financial future. Our mission? To build a seamless, inclusive banking experience—breaking barriers and unlocking new opportunities for all.

Upload or Scan Me

Contact us at

cs_mobile@netbank.ph

Customer Support Team is

only available 8AM to 5PM Monday to Friday

Who are benefiting from Netbank’s solutions

Netbank (A Rural Bank) Inc. is regulated by the

Bangko Sentral ng Pilipinas (BSP)

For any concerns, you may contact them directly at (02) 8708-7087 or email at consumeraffairs@bsp.gov.ph.

Deposits are insured by PDIC up to P1,000,000 per depositor.