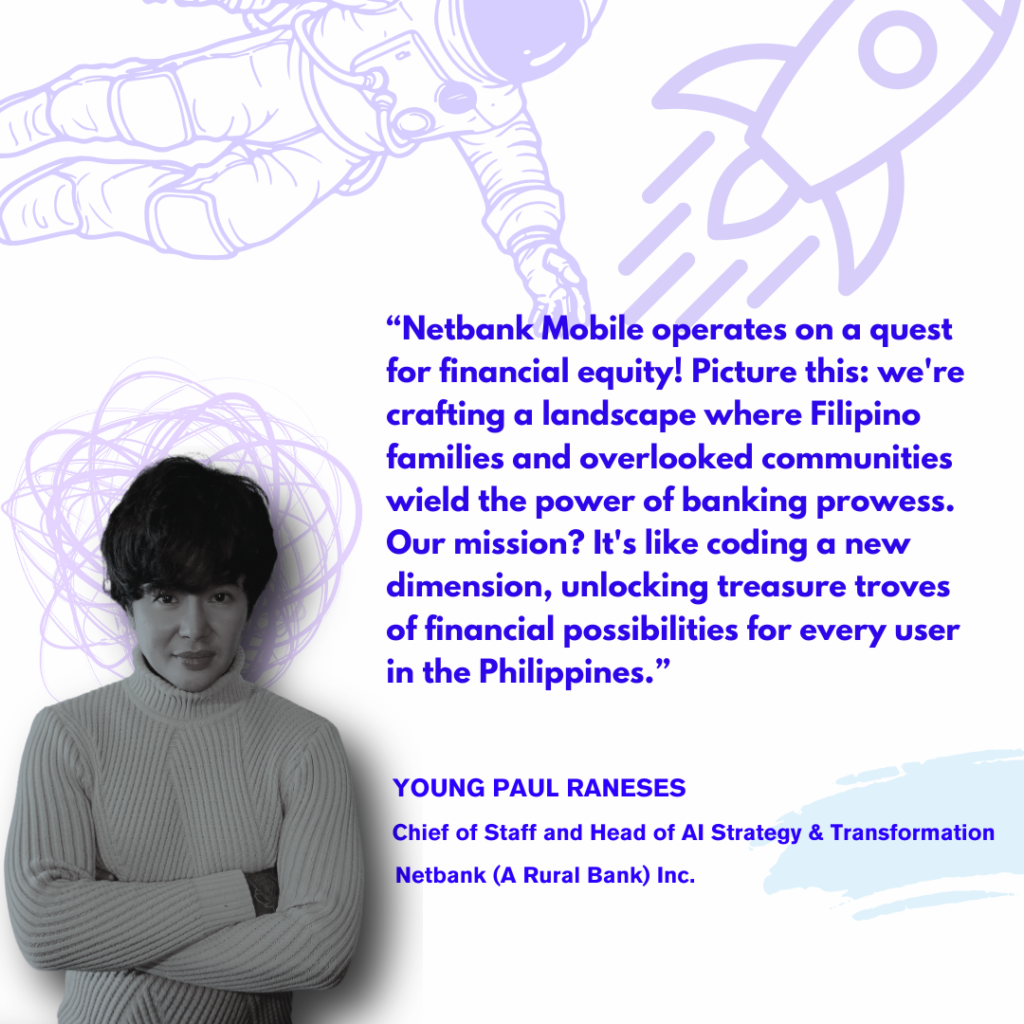

Netbank Mobile is redefining financial accessibility! Imagine a world where every Filipino, from families to underserved communities, has the tools to take control of their financial future. Our mission? To build a seamless, inclusive banking experience—breaking barriers and unlocking new opportunities for all.

Note: No charges/payment shall be asked by the counters and stores on top of your deposit/cash-in or withdrawal/cash-out amount.

Upload or Scan Me

Contact us at

cs_mobile@netbank.ph

Customer Support Team is

only available 8AM to 5PM Monday to Friday

Where can I download the Netbank Mobile Application?

You can download Netbank Mobile Banking Application from Google Play Store and Apple Store.

What type of account I will get after the registration?

Regular Savings Account

What Branch do I need to select during account opening?

💡Digital Banks Ph Tipid Hacks 💸

Acceptable Valid IDs to open a Netbank Savings Account.

I’m done with the Application process, how long will I wait for the Approval/Activation?

How to Activate my Account?

Please watch the video tutorial on how to activate your account. See Video

What is the type of account I will get after the registration?

Regular Savings Account.

How much is the minimum initial deposit?

No minimum initial deposit and No maintaining balance.

What is the Interest Rate?

4% interest rate per annum when you select “💡Digital Banks Ph Tipid Hacks 💸” on the branch selection screen during the account opening.

*Interest rate offered may need to adjust in accordance with Netbank’s asset/liability requirements and market conditions.

When will I receive the Interest Rate?

Interest Computation Guide for New Accounts

Example:

If you deposit today, your first interest will be credited starting tomorrow from 12:00 AM onwards.

Important Note:

The timing of your first interest credit depends on when you fund your account. If the account was created today but you only deposit funds after 2 or 3 days, interest computation will begin after the initial deposit, and will then be based on the EOD balance.

Interest Computation Formulas:

Interest earned is available on the app dashboard, where you can filter your earnings by monthly or yearly view.

What is the minimum end of day balance to earn interest?

At least 69.00 Php (at 4%)

Are you offering a Time Deposit?

Yes, you can open a time deposit, just log in to your Netbank Mobile Application and tap “Term Deposit.

TIME DEPOSIT

Minimum of 10,000 Php, No Cap

New offerings effective April 8, 2025

*Users will see their balance in the Deposit section of Netbank Mobile once it is processed and we will notify you including your Electronic Certificate of Time Deposit.

To check your Time Deposit Account

Here is the formula to calculate the DST (Amount x.75% [DST] x term/365)

Time Deposit Approval

How can I “Change PIN?

I want to Change/Update my Account Details.

To request an update/change of your account details, you can submit a request via Netbank Mobile App. Follow the instructions below.

Step 1: Email Customer Service (CS) to request the code for the change request.Step 2: Follow these instructions in the app:

Step 3: CS will notify you once the change has been implemented.

What do I do if I change my Mobile Number?

To request an update/change of your account details, you can submit a request via Netbank Mobile App. Follow the instructions below.

Step 1: Email Customer Service (CS) to request the code for the change request.

Step 2: Follow these instructions in the app:

Step 3: CS will notify you once the change has been implemented.

Dormant Account

A dormant account refers to an account that has been inactive for 24 months (730 days), with no transactions such as deposits or withdrawals. To re-activate, the account holder must request reactivation and pay a ₱50 dormancy fee.

Steps to Reactivate Your Account:

Step 1: Email Customer Service (CS) to request the code for the change request.

Step 2: Follow these instructions in the app:

Step 3: CS will notify you once the change has been implemented.

Account Closure

Early account closure within 1 year or 365 days is subject to 100Php fee.

Steps for Account Closure Request:

Step 1: Email Customer Service (CS) to request the code for the change request.

Step 2: Follow these instructions in the app:

Step 3: CS will notify you once the change has been implemented.

Is my funds safe?

Yes, you cannot log on without your personally created password, and making transfer transactions will require confirming your PIN.

How can I escalate Phishing, disputes, or any other money transfer problems?

For escalations and other immediate assistance, contact us by sending us a message at cs_mobile@netbank.ph

Netbank to Netbank

The transaction should also be reflected immediately.

Instapay

If it’s a fund transfer using Instapay, the transaction should also be reflected immediately.

Pesonet

If the fund transfer was made on a Friday after 4PM or on a Saturday/Sunday, the transaction will be reflected on the following Monday (earliest by 10:40 AM). We suggest waiting until the end of the day before checking the account.

I type the wrong account number as a recipient for the fund transfer. Can I cancel or undo the transfer?

Fund Transfers Limit and Fees

Pesonet

Instapay

Netbank to Netbank

See below the List of our Cash-In Agents and Fees:

Steps to Cash In via ECPAY Networks If ECPAY Kiosk is Not Available.

Cash-In Fees

List of our Cash Out Agents

To open a merchant account or business account for MSMEs, the following requirements must be met: First, an individual account is needed as a prerequisite before requesting a merchant account. To apply for a merchant account, please complete the online application form on your Netbank Mobile. Follow the instructions below.

1. Open the App

2. Click Settings

3. Click FAQ

4. Select “Merchant Account”

5. Tap “Merchant Account Opening”

6. Complete the required Field and Submit

Prepare the following documents:

A merchant account allows you to accept payments from your customers via QRPH QR Code. With this account, you’ll generate a QR Code for your customers to scan when making payments. Please note that scanning QR Codes of your customers, as well as scanning GCredit and GGives, is currently not supported. Payment collection will only be successful when your customer scans your Merchant QR Code. The fee for any transaction amount is 5PHP. Additionally, transferring funds from your Netbank Merchant account to your Netbank Mobile account is free of charge. There are no payment limits. This merchant account also offers interest at 2% with daily crediting.

The Turnaround time for the Approval after the user submits the merchant account application or after registration is listed below.

Netbank is a participant in QR (Quick Response) PH (Philippines) P2P (Peer-to-Peer) and P2M (Peer-to-Merchant) transactions.

Read more about our Product Disclosure Agreement Here

Who are benefiting from Netbank’s solutions

Netbank (A Rural Bank) Inc. is regulated by the

Bangko Sentral ng Pilipinas (BSP)

For any concerns, you may contact them directly at (02) 8708-7087 or email at consumeraffairs@bsp.gov.ph.

Deposits are insured by PDIC up to P1,000,000 per depositor.